Building a bridge between the capital markets and our homes

Written by Simon Phelan, Founder & CEO of Hometree

Last Friday was an incredibly exciting day at Hometree as we announced that we have raised a £250m asset-backed debt facility from Barclays, the UK’s inaugural residential renewable securitisation, positioning Hometree as a pioneer in shaping a new asset class crucial for decarbonising millions of homes in the years ahead.

I believe this is both a significant milestone for Hometree, but also for the residential renewable market in the UK, and therefore, I wanted to write some thoughts both on what it’s taken to get here, but more importantly, why we think this new facility, and future ones like it, will be a key tool in accelerating the drive to decarbonise our homes.

Background on Hometree

Hometree was founded in 2015 in my bedroom in Islington, North London (as pictured, where I was clearly more excited about getting my first Mac than launching a company), with a business plan (also pictured) titled “Connecting Investors with Sustainable Investment Opportunities”.

Before founding Hometree, I had started my career working for the well-known private equity investor Jon Moulton, and it was here, through one of the investments in Jon’s fund that I first got exposed to the opportunity in decarbonising our homes.

Back in those days, there were incentives for homeowners to put rooftop solar on their home, and the market was seeing significant growth, but it was my discovery of the early pioneers of the US rooftop solar financing market – SolarCity & SunRun – that truly opened my eyes to the potential business opportunity.

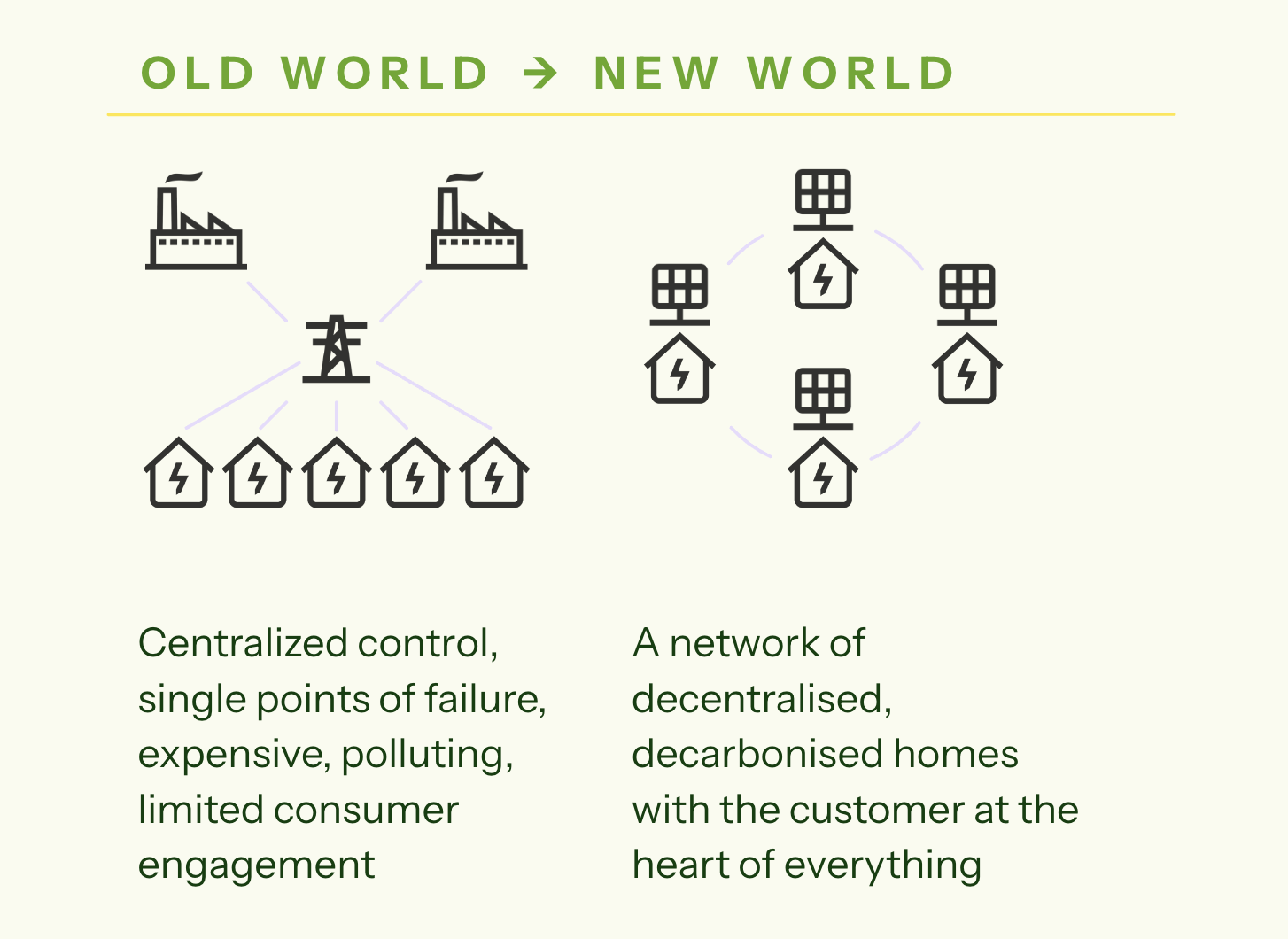

What really stood out to me was that we were at the start of a shift in how we heat and power our homes – from a hydrocarbon based, centralised & linear delivery model (i.e. the grid), to a distributed, renewable based model with millions of generation points (i.e. our homes), and that this transition will shift more and more responsibilities to homeowners, increasing their need for a new type of home services provider which can provide a one-stop solution.

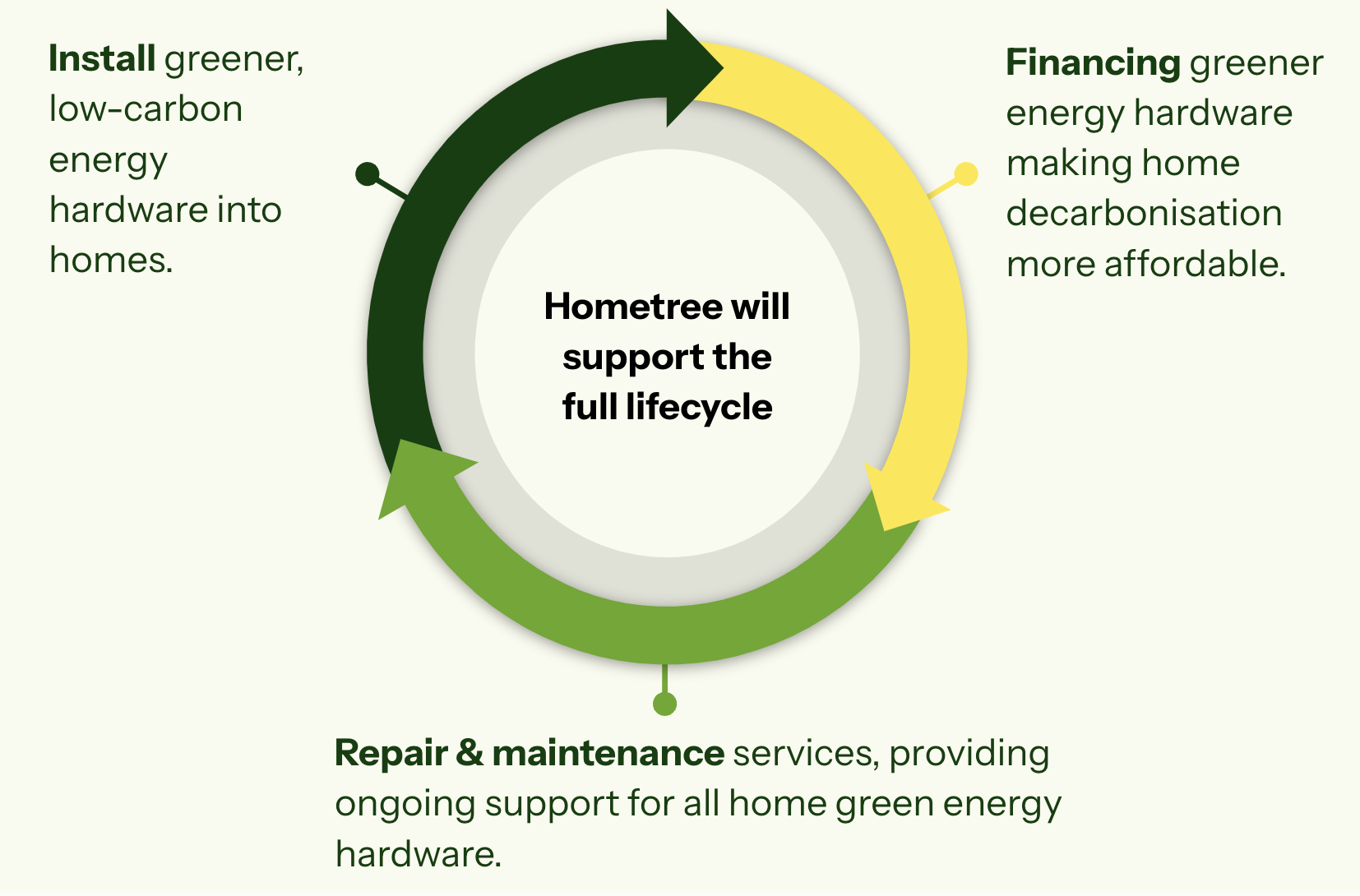

So with a cheque in hand from Jon Moulton and Frontline Ventures, I incorporated Hometree with a vision to build one of Europe’s leading next-generation residential energy services businesses that could help

homeowners across the full lifecycle of home decarbonisation – how the new hardware (solar, batteries, heat pumps etc) gets installed, how it gets financed, and in life, how it gets serviced and maintained.

The Importance of Finance

One thing that was clear to me from the get-go was that as grid infrastructure extends into the fabric of our homes (i.e. solar panels on our roofs which generate electricity, batteries to store that electricity), it won’t necessarily be consumers that will fund this enormous infrastructure upgrade. The CCC estimates an investment of about £250 billion needed to fully decarbonise UK homes by 2050, and as we know only too well from the recent cost of living crisis, the majority of people don’t have a spare £10k/ £20k sitting around to invest in upgrading their heating system, or putting solar on their roofs.

To date in Europe the market has been driven by customers who have been willing to pay cash for solar PV/ heat pumps because they are enthusiastic about the technology, affluent, and/or eco-conscious. However, as government support schemes wane out, the next wave of customers will need more convincing, and we believe widely available and easily accessible financing solutions will be key to removing one of the most significant barriers – high upfront cost.

Research from LCP Delta reveals that already last year 12% of European solar customers bought a solar PV system via a home improvement loan, whilst a further 28% either took out a personal loan or used a personal credit card – evidence that consumers are interested in financing these installations.

But until now finance products for this market in Europe haven’t been great – with low term lengths on offer (i.e. 5 years, max 10 years) and high interest rates. In a market with better product offerings such as the US, the penetration of finance is much higher at >85% for solar PV, which is very similar to financing levels of cars, where between 80%-92% were financed in the UK over the last 3 years.

These facts gave us confidence that over the course of the next two decades, financing products for green home improvements will grow enormously in popularity in Europe, and accordingly in 2023 we acquired BeWarm – now Hometree Finance – a leading point of sale financing platform for green home improvements in the UK.

So who is going to fund this transition?

So if it’s not customers who are going to finance this infrastructure upgrade, who will?

Governments can and are helping, but with stretched national balance sheets and competing priorities, it’s highly unlikely that Governments are going to fund this whole effort either – especially when the numbers are in the hundreds of billions of pounds in the UK alone (trillions across Europe).

Accordingly, our strong view is that it will be private capital, the banks and the capital markets that will be the main financiers of this global, multi-trillion dollar infrastructure upgrade, and it is only there that there exists deep enough pools of cheap capital interested in financing long lifetime (up to 25 years in some cases) assets. Positively, big numbers aren’t a problem for the capital markets – estimates for the overall size of the global bond markets is $128 trillion, and the growth in green bonds is testament to the fact that there is deep desire for funding the energy transition/ sustainability.

The problem with the capital markets is they’re a bit like 1990 supermodel Linda Evangelista and her famous line “we don’t wake up for less than $10,000 a day” – but in the capital markets case, they’re not really interested in deals that are less than a few hundred million dollars in size – given the transaction costs just don’t stack up for smaller deals.

This is a problem for residential decarbonisation, as the average project size is in the tens of thousands of pounds, making them uninvestable for the capital markets on a standalone basis.

Securitising the Air & Sun

Solving this challenge was a key innovation of the early pioneers in the US – SolarCity & SunRun – who packaged thousands of solar lease cash flows into investable bonds or asset-backed securities (ABS), selling them to institutional investors through securitisation.

This not only benefited the companies, who could move most of the costs of installing & financing the solar & batteries off their balance sheets, reducing the amount of capital they needed to grow their businesses, but it also reduced the cost of capital for customers. This is because a key benefit of a securitisation is that the investors are backing the cash flows off the leases/ loans, and they are exposed only to the risks associated with these contracts, rather than the financial risk of the installers’ whole business. As investors in the US got more data over the years, and saw strong performance from the early securitisations, they were willing to offer cheaper costs for the next ones, meaning installers could offer cheaper financing to homeowners, and in turn increase market adoption.

This technique of financing residential renewable upgrades has flourished in the US, and from 2013–2022, there was an aggregate solar ABS issuance volume of over $20 billion – a number that is continuing to increase.

In Hometree’s case, an off balance sheet company holds all the originated leases/loans. Barclays funds the senior tranche, a mezzanine provider will fund the mezzanine tranche, and Hometree funds the junior tranche. Once the SPV reaches £150m+ in leases/loans, a public market securitisation (i.e. the issuance of a green bond) will refinance the senior and mezzanine tranches with long-term, cheaper financing, reducing Hometree’s capital needs and enabling significant scaling.

Hometree’s Opportunity to Build a European Market Leader

So whilst the US residential renewable energy financing market has been growing at pace, driven by scaled players like SunRun, GoodLeap & Mosaic, the challenge in Europe is that the renewable installation market is very fragmented, with only a few players having individual market shares above 1%. This means that there hasn’t been enough mid-to-large sized pools of renewable loans or leases to sell-off to the capital markets.

But positively, this is starting to change, and we believe Hometree can be at the forefront of this change. Firstly, our acquisition of BeWarm last year – now Hometree Finance – gave us a ready made Point-of-Sale financing platform with all the necessary regulatory approvals to offer finance to UK homeowners. Furthermore, their B2B2C business model, where they don’t offer finance directly themselves to customers, but through 3rd party installers who need to comply with strict protocols around how the finance is offered & sold, enables Hometree Finance to reach scale quicker by combining contracts originated by various solar & heat pump installers.

Then as part of Hometree, which already has a scaled home services business where we are looking after over 100k customers critical home infrastructure through our home emergency insurance plans, and where through our buy-&-build program, we have started to be a consolidator of leading regional renewable installation companies, Hometree Finance is able to start to get access to the volume of financing that can deliver sufficiently large pools of loans or leases annually or bi-annually to sell-off to the capital markets. Furthermore, we’re well capitalised and backed by leading investors like Legal & General, one of the largest asset managers in Europe, who are exactly the type of investor that in the future may be buyers of our bonds, given like any pension fund/ life insurer, they need long-dated assets to match against their long-dated liabilities.

That is why Barclays has chosen Hometree as their UK launch partner in this new asset class, and although we’re early in our journey, with this facility now in place, we expect to be able to supercharge our loan and lease book in the coming months, and undertake the first public market securitisation in the UK within the next two years, before hopefully running more regular securitisations as we finance hundreds of thousands of residential renewable installations in the years to come.

What does this mean for homeowners?

Most importantly, for the millions of homeowners who haven’t yet been fortunate enough to be able to afford to reduce their energy bills by installing solar, batteries or heat pumps, we believe this transaction can be a game changer for the market by introducing long term financing contracts with low interest rates. Over the coming months we hope to be able to offer our financing products through a broader set of installer partners, with our ultimate goal as a company being to help decarbonise over one million homes by 2030.

So all in all, we believe this is a real win-win-win transaction – a win for investors who get access to a new, incredibly exciting green asset class with huge growth potential, a win for Hometree as we can scale our business up to be a European market leader in this new category of next generation residential energy services, and a win for households who will be able to access affordable financing options and reduce their energy bills whilst doing their bit for the environment.

We couldn’t be more excited about getting to work deploying this capital.